In the world of cryptocurrency and blockchain technology, investors are constantly seeking opportunities for significant returns from their investments. The concept of Crypto30x has emerged, referring to the potential for a cryptocurrency to increase its value by 30 times its original price. While achieving such dramatic growth is rare and comes with substantial risks, it represents the kind of explosive potential that draws many to the crypto market. In this article, we’ll explore what crypto30x blockchain is, its significance, and what factors and opportunities can drive crypto30x growth.

Table of Contents

What is Crypto30x in Blockchain?

Crypto30x refers to the potential for a cryptocurrency to increase its value by 30 times its original price. In other words, if you invest $1,000 in a cryptocurrency that achieves 30x growth, your investment would be worth $30,000. This concept represents the dream of many crypto investors, to find that one coin or token that can deliver exponential returns.

The significance of Crypto 30x lies in its promise of substantial wealth creation. In a market known for its volatility and rapid growth, achieving a 30x return is not just a pipe dream but a possibility that has been realized by some investors in the past. This potential for high returns is what draws many to the cryptocurrency market, despite its inherent risks.

Crypto30x growth represents the transformative power of blockchain technology and its ability to create value in ways traditional finance cannot. When a cryptocurrency achieves such dramatic growth, it often signals strong market adoption, technological innovation, or a shift in the broader crypto ecosystem.

Does Crypto30x Really Happen?

While 30x Crypto growth might sound too good to be true, history has shown that it is indeed possible. Several cryptocurrencies have achieved and even surpassed 30x growth, especially during bull market cycles. For example:

- Solana (SOL): In 2021, Solana saw its price surge from around $1 in January to over $200 in November, representing more than a 130x increase.

- Dogecoin (DOGE): This meme-inspired cryptocurrency experienced a meteoric rise, going from less than $0.01 in early 2021 to a peak of about $0.73 in May of the same year – a growth of over 70x.

- Ethereum (ETH): While not a 30x in a single year, Ethereum has shown remarkable long-term growth, rising from about $8 in 2017 to peaks over $4,000 in 2021 – a 500x increase over four years.

These examples demonstrate that crypto30x growth is not just a theoretical concept but a real possibility in the cryptocurrency market. However, it’s crucial to note that such dramatic increases are the exception rather than the rule, and they come with significant risks. Hence, each individual should do proper research before taking further steps in this highly volatile ecosystem.

Top Cryptocurrencies in 2024 with Potential of 30x Return

As the cryptocurrency market continues to evolve, investors are always on the lookout for the next big opportunity. While achieving 30x returns is an ambitious goal and comes with significant risks, some cryptocurrencies show promising potential for substantial growth in 2024. Here’s a look at seven top contenders that could see remarkable gains:

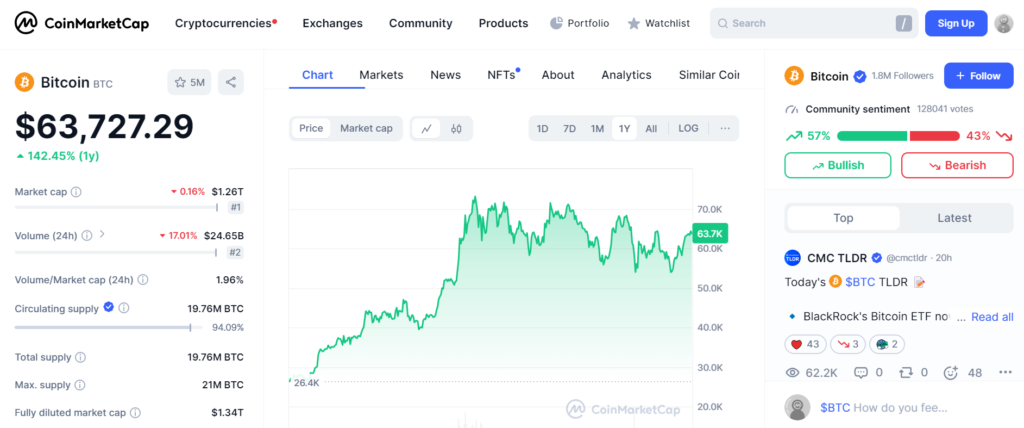

Bitcoin (BTC)

Despite being the oldest and most established cryptocurrency, Bitcoin still holds immense potential for growth. With the anticipated approval of Bitcoin ETFs by the SEC in early 2024 and increasing institutional interest, Bitcoin could see a significant price surge. In March 2024, Bitcoin hit its highest price ever and that was over $73,000.

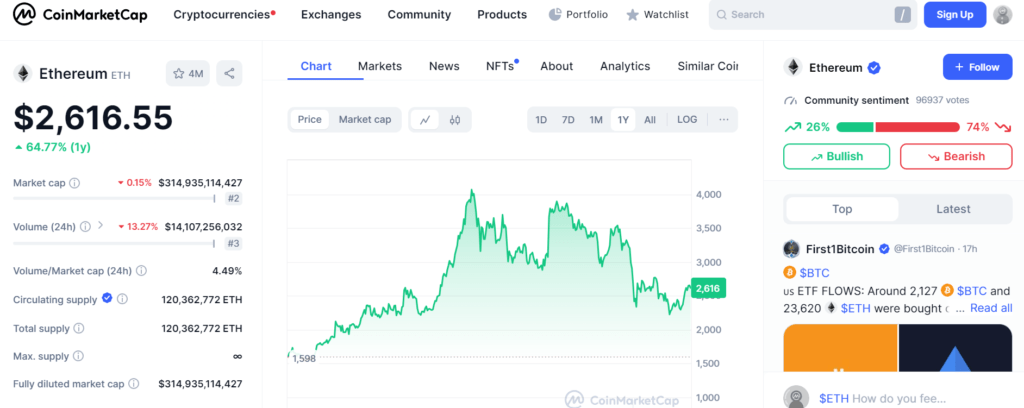

Ethereum (ETH)

As the backbone of decentralized finance (DeFi) and smart contract functionality, Ethereum continues to be a strong candidate for substantial growth. With ongoing upgrades to improve scalability and reduce transaction costs, ETH could see increased adoption and value appreciation. The transition to Ethereum 2.0 and the growing NFT market could be key drivers for ETH’s potential 30x growth. there are different predictions about ETH’s 30x growth, some say it will grow to around $3400 by the end of 2024 and others say it could hit $7,400

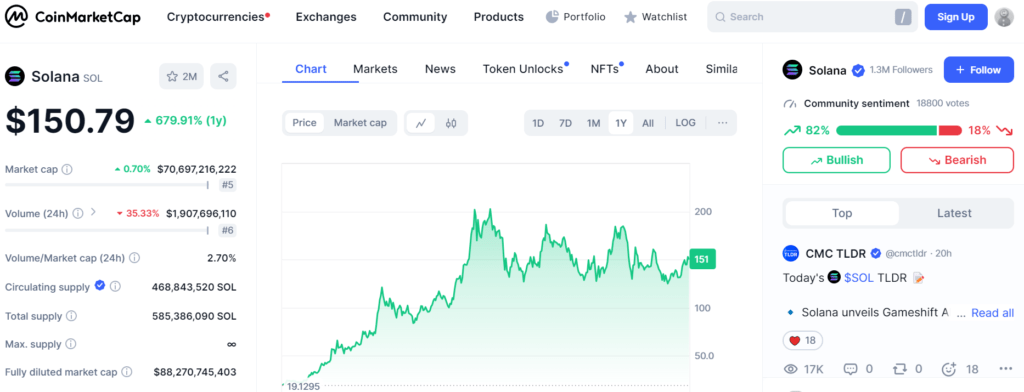

Solana (SOL)

Solana has been making waves with its high-speed, low-cost transactions, making it a favorite for DeFi projects and NFT marketplaces. The recent success of Solana’s mobile phone project and growing developer interest suggest that SOL could see explosive growth in 2024. Analysts predict SOL could reach triple digits, potentially hitting $170-$200 by year-end.

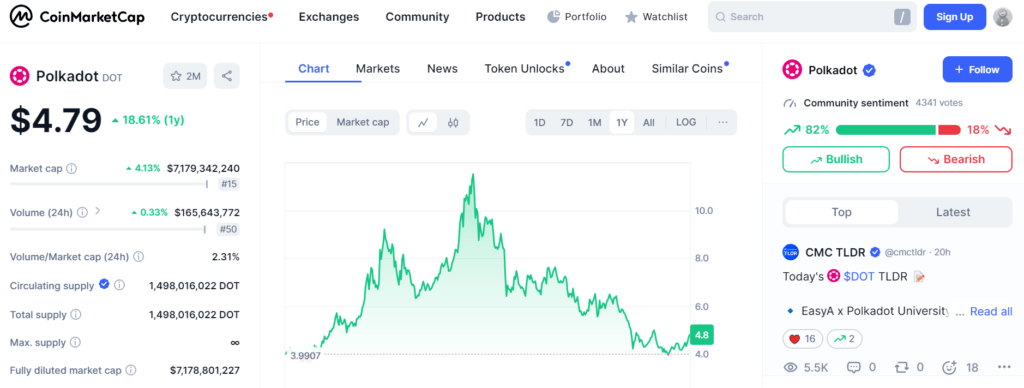

Polkadot (DOT)

Polkadot’s innovative approach to blockchain interoperability positions it well for future growth. As more parachains launch and integrate with the Polkadot ecosystem, DOT could see increased demand and utility. The growing need for cross-chain communication in the blockchain space makes Polkadot a strong candidate for substantial returns

Avalanche (AVAX)

Avalanche’s high-performance blockchain platform has been gaining traction in the DeFi and enterprise blockchain sectors. Its unique consensus mechanism and ability to handle complex decentralized applications could drive significant adoption. As more projects build on Avalanche, AVAX tokens could see a dramatic increase in value. As per analysts, it is expected to hit an average price of $31 by the end of 2024.

It’s important to note that while these cryptocurrencies show promise, the crypto market is highly volatile and unpredictable. Investors should always conduct thorough research, consider their risk tolerance, and potentially consult with financial advisors before making investment decisions. Remember, past performance does not guarantee future results, and the possibility of significant losses always exists in the cryptocurrency market.

What Opportunities Do We Have to Enhance Crypto Growth in 2024?

Crypto has experienced massive surges in the past, especially during market booms, and certain sectors or projects could potentially offer such returns. Here are some areas where you might find opportunities for significant growth in 2024:

Layer-2 Scaling Solutions

Layer-2 protocols aim to scale blockchains like Ethereum by reducing congestion and improving transaction speed without compromising security. As Ethereum’s Layer-1 becomes more congested, Layer-2s could see explosive adoption, especially with the rise of decentralized applications (dApps) and decentralized finance (DeFi).

Decentralized Finance (DeFi)

DeFi platforms provide decentralized financial services (lending, borrowing, staking, etc.), and the space has already seen rapid growth. However, it’s still in the early stages. Innovations in decentralized lending, yield farming, derivatives, and insurance could lead to increased adoption, especially in underbanked regions or in response to traditional financial crises.

Web3 and Decentralized Applications (dApps)

Web3 projects aim to decentralize the internet, shifting power from centralized platforms like Google and Facebook to users. The internet’s shift to decentralization could create massive opportunities, especially as more developers and companies build on decentralized infrastructure.

Metaverse and Non-Fungible Tokens (NFTs)

The Metaverse is a virtual universe, and NFTs (non-fungible tokens) allow for digital ownership of assets. The potential growth in virtual worlds and digital goods is immense. Some of its examples include Decentraland, The Sandbox, Axie Infinity, Gala Games.

Big players like Meta (formerly Facebook) are pushing the metaverse concept, and if digital ownership becomes mainstream, there’s huge growth potential for NFT-related cryptocurrencies and metaverse tokens.

Blockchain Interoperability

Many blockchains operate in silos, but interoperability solutions allow different networks to communicate and transfer assets smoothly. As more blockchains are built, the demand for seamless cross-chain communication will grow, which could boost blockchain interoperability projects significantly.

Decentralized Autonomous Organizations (DAOs)

DAOs enable decentralized governance, where token holders make collective decisions on a project’s future. The potential for DAOs to disrupt traditional governance models in various sectors is high.

If DAOs become widely adopted for managing decentralized projects or even real-world entities, the tokens governing these projects could experience massive growth.

Tokenization of Real-World Assets (RWA)

Real-world assets, such as real estate, stocks, bonds, and commodities, can be tokenized and traded on the blockchain. This market could offer tremendous liquidity to traditionally illiquid assets. The integration of traditional assets into blockchain ecosystems could bring institutional investors into the space and create new markets, offering substantial growth potential.

Regulatory Clarity and Institutional Adoption

As governments and regulators provide clearer frameworks for cryptocurrency and blockchain technology, large financial institutions and corporations may increasingly adopt blockchain solutions.

Regulatory certainty can pave the way for more institutional investment, boosting market confidence. Large-scale financial products, such as Bitcoin ETFs, could also drive significant price growth.

Energy and Green Crypto Projects

As environmental concerns grow, energy-efficient and eco-friendly cryptocurrencies are likely to gain attention. The shift to Proof of Stake (PoS) and carbon-neutral blockchains could drive adoption.

The global push toward green technology and sustainability could favor eco-friendly blockchain projects and incentivize their growth.

Factors That Can Drive Crypto30x Growth

While there’s no guaranteed formula for achieving Crypto30x returns, investors can consider the following strategies that could help them grow their assets:

- Market Adoption: Widespread adoption by users, businesses, or institutions can drive a cryptocurrency’s value significantly higher.

- Tokenomics: Well-designed token economics that encourages holding and use can contribute to price appreciation.

- Technological Innovation: Cryptocurrencies that introduce groundbreaking technology or solve significant problems in the blockchain space have a higher chance of achieving dramatic growth.

- Partnerships and Integrations: Strategic partnerships with established companies or integration into popular platforms can drive demand.

- Fundamentals: Ensure the project has strong technology, a robust team, and real-world use cases.

- Risk Management: 30x returns typically come with high volatility and risk. Diversification, research, and an understanding of the project’s long-term potential are essential.

- Timing: The overall market cycle (bear vs. bull) plays a big role in how quickly a project can grow.

- Research and Due Diligence: Thoroughly investigate cryptocurrencies, focusing on their technology, team, roadmap, and market potential.

- Diversification: Don’t put all your eggs in one basket. Spread investments across multiple promising projects to balance risk and potential rewards.

- Early Adoption: Look for promising projects in their early stages, as these often have the highest growth potential.

- Long-term Holding: Be prepared to hold investments for extended periods, as significant growth often takes time.

- Stay Informed: Keep up with market trends, news, and technological developments in the crypto space.

- Risk Management: Only invest what you can afford to lose, and have a clear exit strategy.

- Understand Market Cycles: Learn to recognize different phases of market cycles and critically analyze to make informed decisions about entry and exit points.

- Continual Learning: The crypto market evolves rapidly, so commit to ongoing education about blockchain technology and market dynamics.

Conclusion

The Crypto30x concept represents both the enormous potential and the significant risks in cryptocurrency investing. While achieving 30x returns is possible, it requires a combination of research, strategy, timing, and, admittedly, a bit of luck. As we look towards 2024, the crypto market continues to evolve, presenting new opportunities for growth and innovation.

However, it’s crucial to approach this growth concept with a balanced perspective. For every success story, there are numerous examples of cryptocurrencies that have failed to live up to their promise. Responsible investing, thorough research, and a long-term outlook are key to navigating the volatile world of cryptocurrency.